If So-called ‘Ownership Rights’ of Money Are Deprived, Mainstream Media Should Speak About It

AST year I wrote a rant about how I could not withdraw/retrieve my own money from the bank. It was new to me that banks can simply deny withdrawal of one’s deposited money. I actually had to spend many hours and make many visits to the bank to eventually get my own money. A lot of that was to do with limited supply. There was also a surveillance element to it (the bank looking for ‘proof’ of how I would use the withdrawn money as if it’s any of their business).

AST year I wrote a rant about how I could not withdraw/retrieve my own money from the bank. It was new to me that banks can simply deny withdrawal of one’s deposited money. I actually had to spend many hours and make many visits to the bank to eventually get my own money. A lot of that was to do with limited supply. There was also a surveillance element to it (the bank looking for ‘proof’ of how I would use the withdrawn money as if it’s any of their business).

These things seem to be getting worse over time.

I had a chat with a friend of mine today. He noticed something which, as far as I’m aware, nobody in the media is writing about.

Britain recently changed its coinage and banknotes. It changed these very fast. I was surprised if not shocked. Within just a couple of months they claimed that the old physical currency would no longer be accepted, except perhaps in unusual circumstances. Machines stopped accepting the old coins. What does that mean for Brits living abroad or people keeping their own money (physically)? Not on some computer in some bank or a virtual/digital account…

Either way, the push towards full surveillance of financial transactions is in full swing. And it’s getting harder to ‘opt out’ so to speak…

“I’m not sure if it is significant,” my friend told me, but there is a major cash shortage in Sweden since they replaced all the coins and bills last year.” There is this report about it (automated translation from Swedish).

“This second link shows that there are more than 3 orders of magnitude fewer medium-sized bills in circulation,” my friend continued.

So they may be making wrong assumptions about demand for cash, or rather making a self-fulfilling prophecy about it.

“It looks like they have aimed at forcing the cashless issue through deliberate hardship,” my friend bemoaned/ranted over this. “And, yes, there are obvious privacy implications among many other problems.”

“Has someone out there written an article about this in English,” I asked him. “If not, maybe we should.”

And hence the point of this post. I read a lot of articles every day, almost all day long. Rarely if ever is the subject of payment privacy brought up. The only site that habitually covers it belongs to Rick Falkvinge or his business (VPN). He is Swedish and he is familiar with this subject.

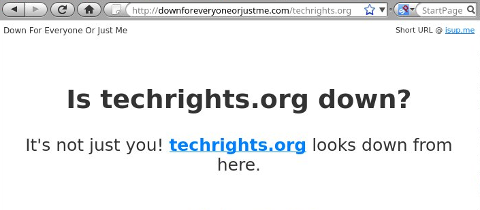

“Rick Falkvinge has mentioned it in passing during his many posts about Bitcoin,” my friend told me. “His main site is not really available and has only a placeholder left, it appears.”

My friend wants to read the site, but JavaScript has rendered Falkvinge’s obsolete. I told Falkvinge about it quite a few times in the past; he said he would look into it, but he never tackled the issue. But I digress…

“There were some articles about an old lady who tried to cash in her savings but was denied by the banks,” my friend recalls, “losing her life savings as a result. She died a short time after that, family claim that the economic blow hastened her death. As it costs a lot of money to keep anything in the bank and more to get anything back out of the bank the economically wise thing to do in Sweden for about two decades has been to keep it in the mattress.”

I did read several articles about that debacle (at the time). It showed that the old practice of keeping one’s own money is becoming too risky. There is a hidden cost (inflation/interest rates) and a high risk (not just of someone breaking into one’s house to steal the cash). See what Modi did some months ago in India. It was incredible. I was shocked that many Indians fell for the propaganda (as if only criminals keep a lot of cash) and tolerated what Modi had done. This reminded me of that time Cyprus denied bank withdrawals and simply grabbed a large portion of people’s personal savings, demonstrating in that particular case the very high risk of keeping money in the bank, not outside it (see what people in Argentina do nowadays). That goes back to the point made at the start — my point about things getting worse over time. Money was always a man-made concept if not an illusion, but over time we see more visible indicators of this. Some cash machines too have been letting me down lately. Years ago I surveyed shops around here to see which ones make it possible to purchase a mobile phone with cash and also top it up with cash (to maintain anonymity).

With few exceptions (sites like Zero Hedge), the subject is grossly unexplored and corporate press rarely touches it.

“I digress,” my friend told me, as “the short answer is that I have not run across any such articles. Do you think that Rick Falkvinge would have interest in collaborating on such an article? It’s kind of his area subject-wise.”

My friend too recalled what happened in India: “India has been having problems like that too and might be included. And don’t forget what China is doing in that area either. Of course, Microsoft, Facebook, Apple, and the others all want to be the sole gateway for payments. Failing that, they want a large piece of the pie.

“One of the official lines that gets repeated every time though is that it will inhibit tax dodging (small fish only, somehow they are not concerned by large fish) and illegal transactions. It occurred to me a few minutes ago that Sweden has a growing yet already massive black market economy in and adjacent to their 61 no-go zones. So maybe this is a low-key attempt to get society back.”

Filed under:

Filed under:

HILE Mr. Trump fights for his “safe space” by

HILE Mr. Trump fights for his “safe space” by