Video download link | md5sum 9364e74c9fb26a531bfe13118066b89d

When Companies Lie to Applicants

Creative Commons Attribution-No Derivative Works 4.0

Summary: Pension fraud and other crimes rendered my last employer incapable of recruiting and retaining staff; we want to make this a cautionary tale for other companies and technical workers out there while at the same time working towards full accountability

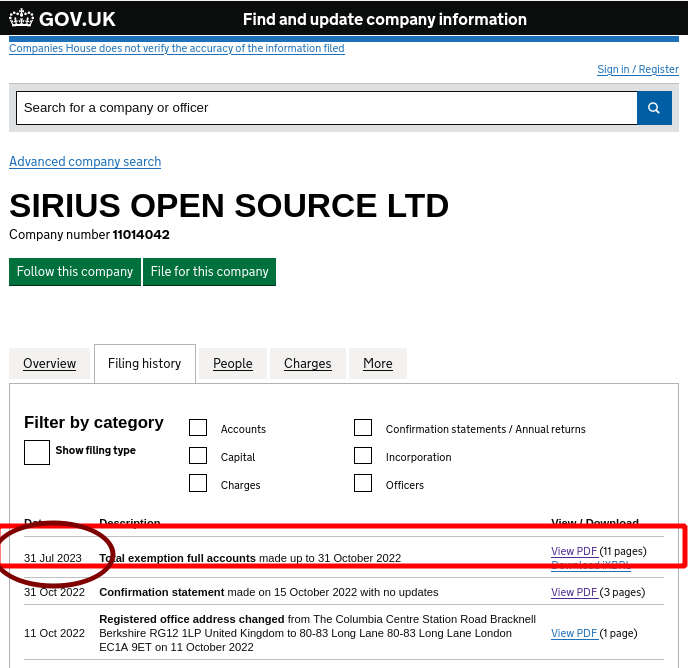

I was running background checks on this company as “Seems too good to be true” situation,” a person told us about Sirius ‘Open Source’. It later turned out that this person was nearly ready to work for the company. But a little bit of research changed the plans.

As it turns out, our series continues to have a lot of impact even about a year later. We knew the company very well (I was there since 2011 and my wife since 2013), but we didn’t know until this year about the pension fraud. Things got really bad in the last 4 years and especially the last year (2022). The video above explains more.

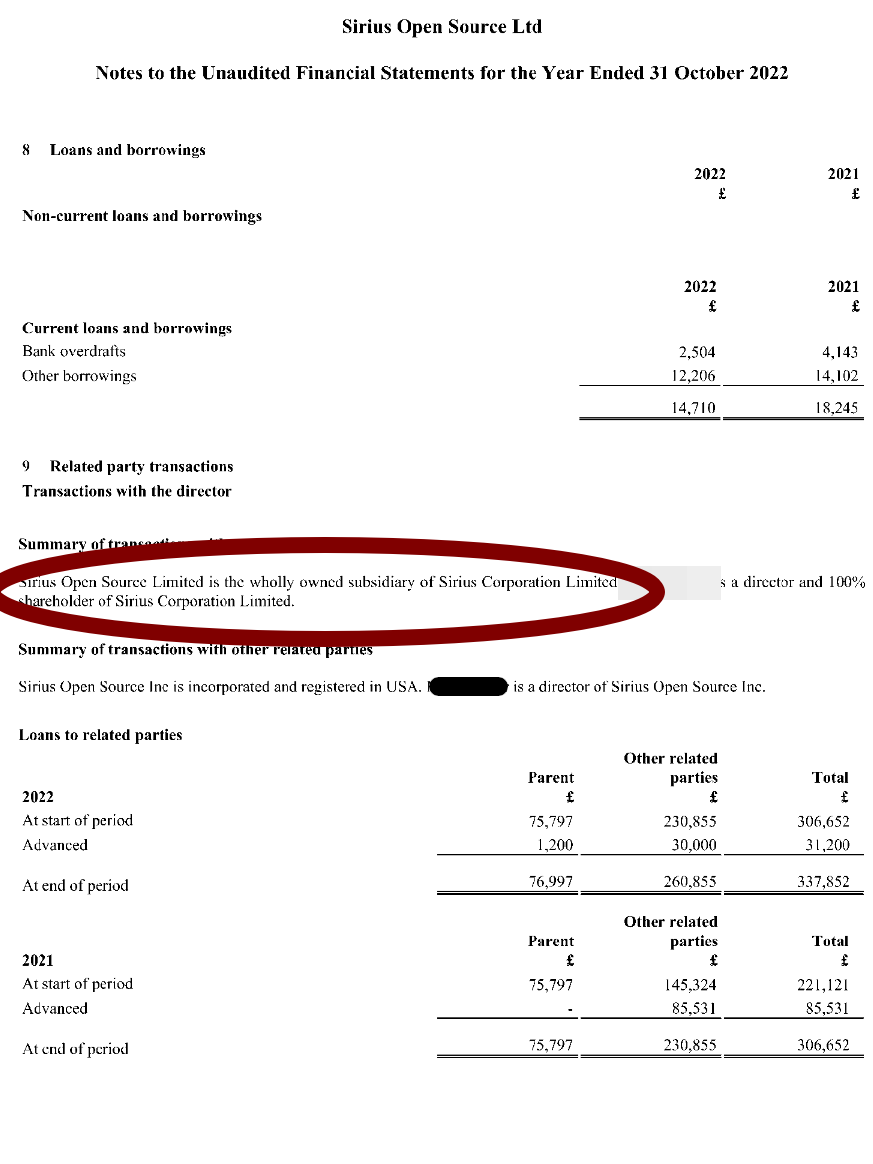

“I’m just starting my Linux career,” the person above told me. He was under the impression Sirius was based in two places, so I had to clarify that the company is almost 100% UK, but it is hiding in the US (dodging the law since around 2019). Apparently it’s not so uncommon a practice (there is a new shell in the US, bearing the name “Inc.”).

“I’m stuck in a position as this would be a good stepping stone for me,” the person said, “but I don’t want to deal with company drama.”

“Also they offered an extremely low amount (25k) for a technical role (understandably, helpdesk but Linux based… hmm).”

“Reading your posts about them being skimpish with cash I can completely understand,” he added.

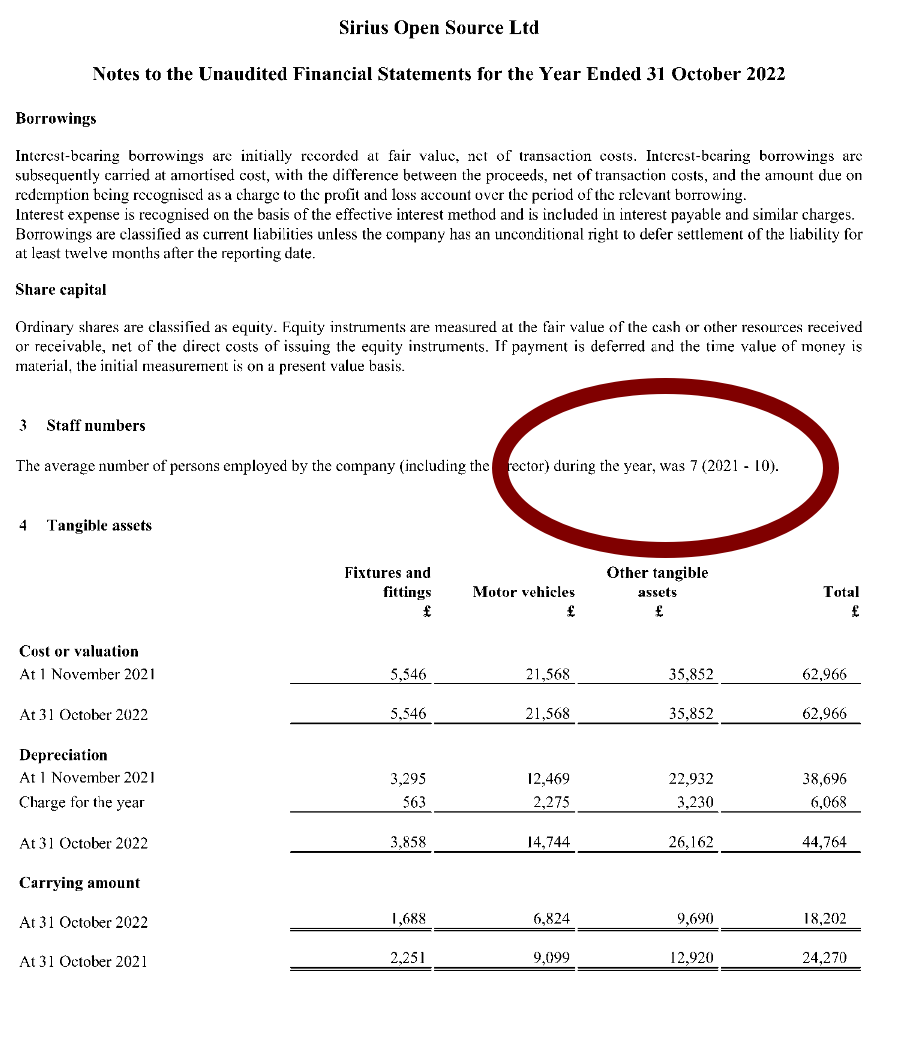

I explained to him that some salaries were in fact reduced over time, not even taking inflation into account (my highest per-hour salary was in 2011 when I had just joined the company!) and one co-worker from the southern hemisphere, now living with his wife in England, was paid 21k for the same position as his colleagues. So there was an element of exploitation and even a ground for litigation (if he chose to pursue that; it’s not cheap). Yes, same role, different salary.

I also mentioned the nepotism, lack of holiday pay and so on. There’s the whole “Google is your friend” mindset as well. “One of the questions I was being asked is “What are your skills like with Google workspace etc”,” the person recalled. So they’re still rejecting “Open Source”, even though it is in the company’s name.

“I hope this page gets more exposure so that people don’t fall for this,” the person added. “I’m still in two minds, because choices are pretty limited for junior devops type work and exposure in large enterprises.”

Remember this was in 2023 when companies laid off many people while imposing some strict “hiring freeze” policies. So many people were desperate to either get in or merely stay inside.

But “the gig won’t last long,” I told him, so it might not be worth the trouble. It can get uglier when HMRC and police get involved. This is an ongoing issue and we’ll make further progress.

There’s a lot more in the video above, but I’ve carefully omitted some details to protect the person in question from reprisal.

was going to report something negative, but at the last minute there was a breakthrough.

was going to report something negative, but at the last minute there was a breakthrough.

Filed under:

Filed under:

HE attempts to compel the British government to hold Sirius accountable for financial crimes won’t end soon. The British government was the biggest client of Sirius, so there’s an incentive to bury it all under some rug somewhere.

HE attempts to compel the British government to hold Sirius accountable for financial crimes won’t end soon. The British government was the biggest client of Sirius, so there’s an incentive to bury it all under some rug somewhere.