Even the CEO left last month!

Summary: Amid inflation, in light of Sirius workers leaving in droves, salaries have been cut even further (they’re looking to pay GNU/Linux engineers as little as 20,000 a year for an overnight job, including weekends and holidays!); of course many won’t know some of that sum will moreover been stolen (embezzlement) under the guise of “pension”

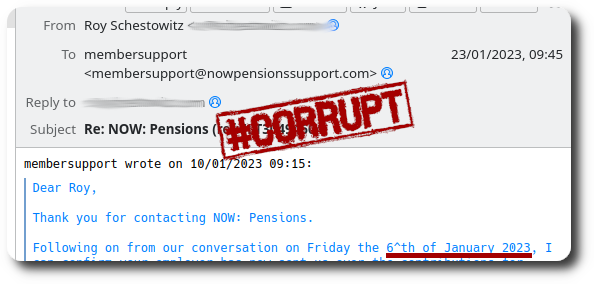

Bonus: The current pension provider has been put on notice regarding pension fraud at Sirius ‘Open Source’ . This has been escalated to the top management there. New letter below.

Dear Roy,

NOW: Pensions Trust (“the Scheme”)

Thank you for your time and patience allowing us to investigate your concerns, we very much regret that it has been necessary for you to contact us with your concerns.

Our understanding of your complaint is your concern that your NOW Pension is not safe due to your previous boss of Sirius potentially being involved in suspicious activities regarding the collection

of contributions.

It was necessary for us to refer your concerns to our compliance department; they have come back with the following information.

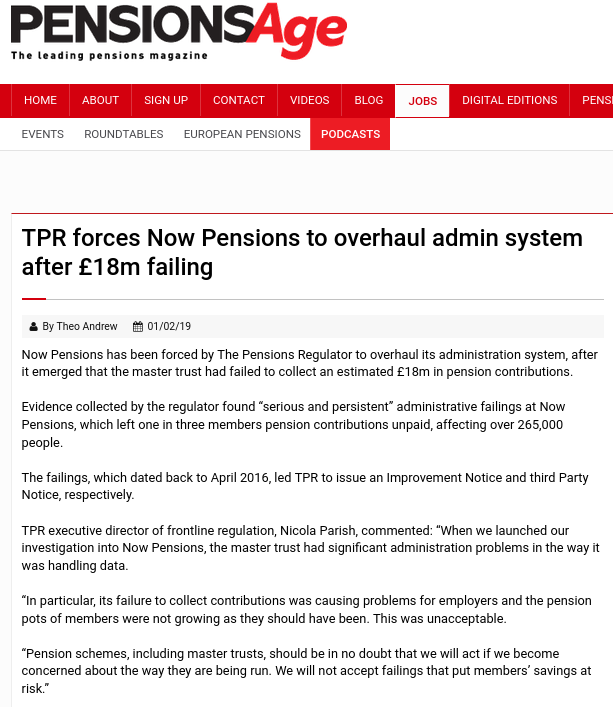

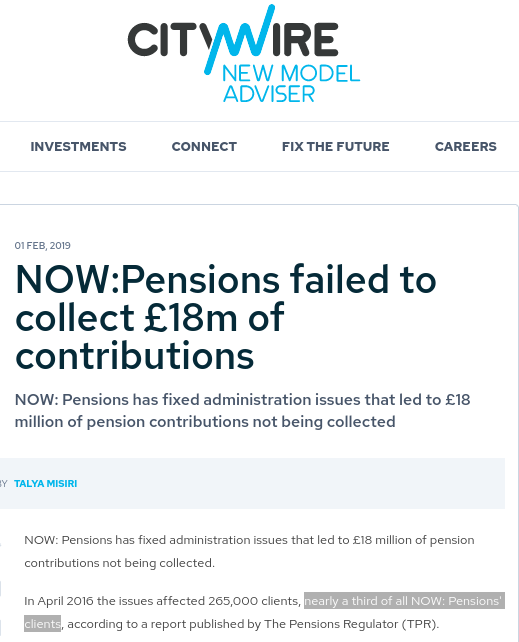

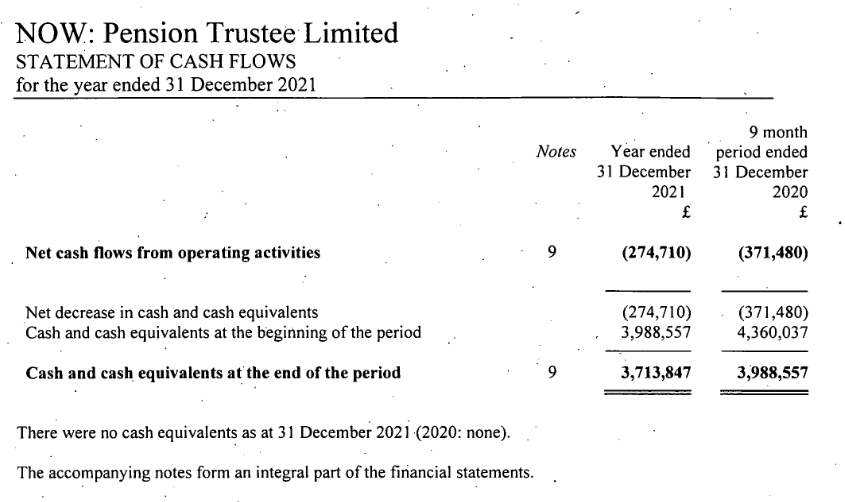

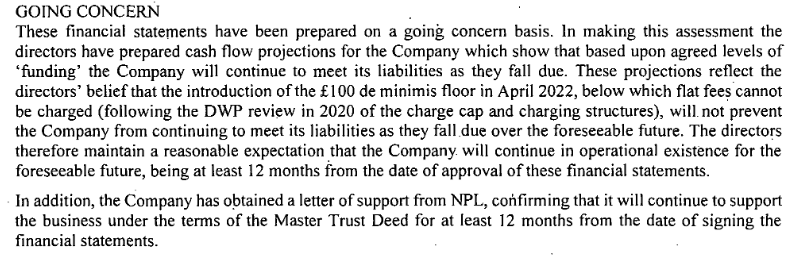

NOW: Pensions are authorised and regulated as a master trust by The Pensions Regulator (TPR). We’re one of approximately

38 master trusts approved and supervised continuously by TPR to maintain the quality of master trust providers in the UK. This means increased protection for members and their pension savings.

We employ a specialist company known as a

custodian, which is responsible for guarding and protecting your money. It holds your pension savings, and those of all members, under a custody agreement (which is protected

by the law) until you ask for your benefits to be paid. The money is kept in a ring-fenced account which is separate from both NOW: Pensions and the custodian’s own funds and company accounts.’’

Our custodian is

BNY Mellon, one of the world’s largest custodians. It looks after over US$30 trillion on behalf of pension schemes and other investors.

The above protection is only applied to funds that have been paid over to us.

Please also note that if you are a deferred member of the scheme ie you have stopped contributing the following charges will still apply:

-

A monthly administration charge of £1.75 (£21 a year) which covers the cost of running the Scheme.

-

An annual investment charge of 0.3% of the value of your savings. This covers the cost of investing your money.

However,

we won’t take any administration charges if this deduction would result in your pension savings account falling below £100.

I hope this helps to settle your concerns regarding your NOW Pension fund, as you can see from the above, they have outlined how and who is responsible for protecting your pension savings and applies to

all NOW Pensions members.

Should you consider that this does not bring the matter to a conclusion, you can request that the Trustees review the matter through the Internal Dispute Resolution Process (IDRP).

Please contact us or visit:

https://www.nowpensions.com/contact-us/internal-dispute-resolution-process/

You can also contact Money Helper for assistance:

Money Helper (formerly The Pensions Advisory Service)

120 Holborn, London EC1N 2TD

Telephone: 0800 011 3797 Website: https://www.moneyhelper.org.uk/en/pensions-and-retirement

If you have general requests for information or guidance concerning your pension arrangements contact:

We’re here to help. If you have any questions or need information, you can call us on 0330 100 3334 from 9:00 am to 5:00 pm, Monday to Friday. Calls may be recorded and monitored for

quality purposes. When you call, please quote the reference above, your full name and National Insurance number. This will help us to help you faster.

You can also email us at membersupport@nowpensions.com or write to us by post. Please quote the reference above, your full name and National Insurance number in any correspondence.

Yours sincerely

Neil Morris

NOW: Pensions Trust Administration Team

For the record: Standard Life investigators now have several formal complaints from several different victims of Sirius pension fraud. It’s hardly surprising that remaining workers are fleeing (almost nobody is left, so the company lies about who’s there).

Filed under:

Filed under: