Sunak already has his own share of financial scandals (his wife also)

“The Prime Minister promises to take the fight to the fraudsters by blocking scams ‘at the source’,” says Which? this week

Summary: The crimes of the rich (or white-collar crimes) are tolerated by our administration; not enough resources are devoted to tackling the most costly crimes, as the case of Sirius fraud shows (I’m a victim of this crime, as are my former colleagues)

ALMOST 14 days ago (2 weeks) I reported fraud to the police and got a reference number for the investigation. In less than 24 hours it’ll be officially a fortnight and they didn’t bother to contact me, follow up etc.

A saner system would do a preliminary check, freeze the assets of the company to recover stolen money, then pursue prosecution based on the evidence. In light of the impending “coronation” ceremony, this matters even more. They apparently have plenty of money/budget (the media says £250m) to protect a person in his 70s throwing a party for himself, but not enough to tackle actual crime (rather than hypothetical… or a mere risk).

“If they don’t respond,” said a colleague about Sirius ‘Open Source’ last month (he too was plundered/defrauded), “I should be able to make a small claims court claim online. I have proof from standard life saying I was not on the scheme and proof they took deductions from my pay, and a copy of the letter outlining the scheme I should have been on so should be reasonably straight forward.”

I can do the same. But the problem is that the company is ‘in hiding’. Downsides of such a course of action:

- they will dodge the legal process.

- we need to hold them criminally accountable (this is jailable offense).

- the company will claim to be broke, unable to recover the money.

The other victim asked: “What else do you have from Standard Life?”

We probably have what we need; that helps show they profited from the fraud too, but they are not directly accountable in this case.

“I have a letter from the IFA and some Standard Life booklets but nothing else,” the colleague said. I have the same. “If Standard Life simply never got contacted to enroll us, I can’t see there is anything else they can help us with.”

Yes, they cannot be held accountable, but they ought to be shamed for facilitating the scam. “If they did not follow protocols,” I said, “designed to prevent such pension fraud, then they breached rules and can be reported. But whether protocols were not followed I cannot tell you as I’m Not a Lawyer (IANAL). I suggest you go ahead and contact the company.”

It has been nearly a month now and the company refuses to even speak.

“I just looked at the fees for an online money claim through the small claims court,” the other victim said. “It’s basically 5% of the claim which could get quite expensive especially if there is no real company left to enforce against. Also I left just over [redacted] years ago so maybe out of time to make a claim.”

Just because a crime took place a long time ago doesn’t mean the police should not prosecute. Litigation is another matter.

Anyway, it’s now at the hands of the police. Let’s see what they do, if anything…

If police fails to take action despite all the evidence of the crime being sent to cops and put on their laps, then it’s fair to say that the police is enabling the crime. It is in some sense complicit by deliberate inaction. White-collar criminals would be delighted to know this; it means de facto immunity/impunity or a carte blanche to carry out more such crimes.

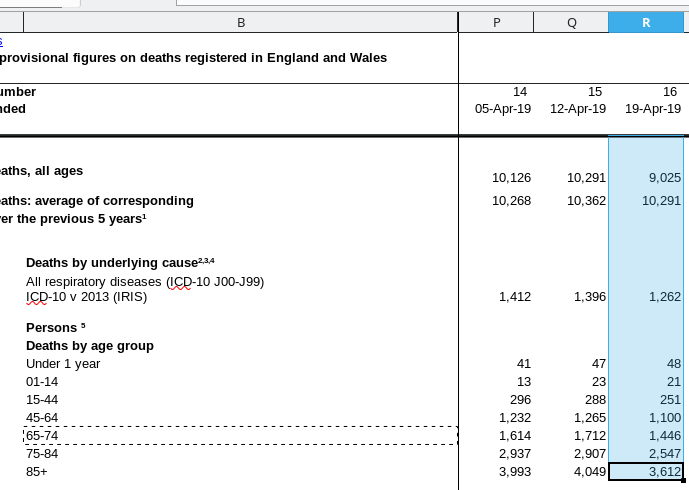

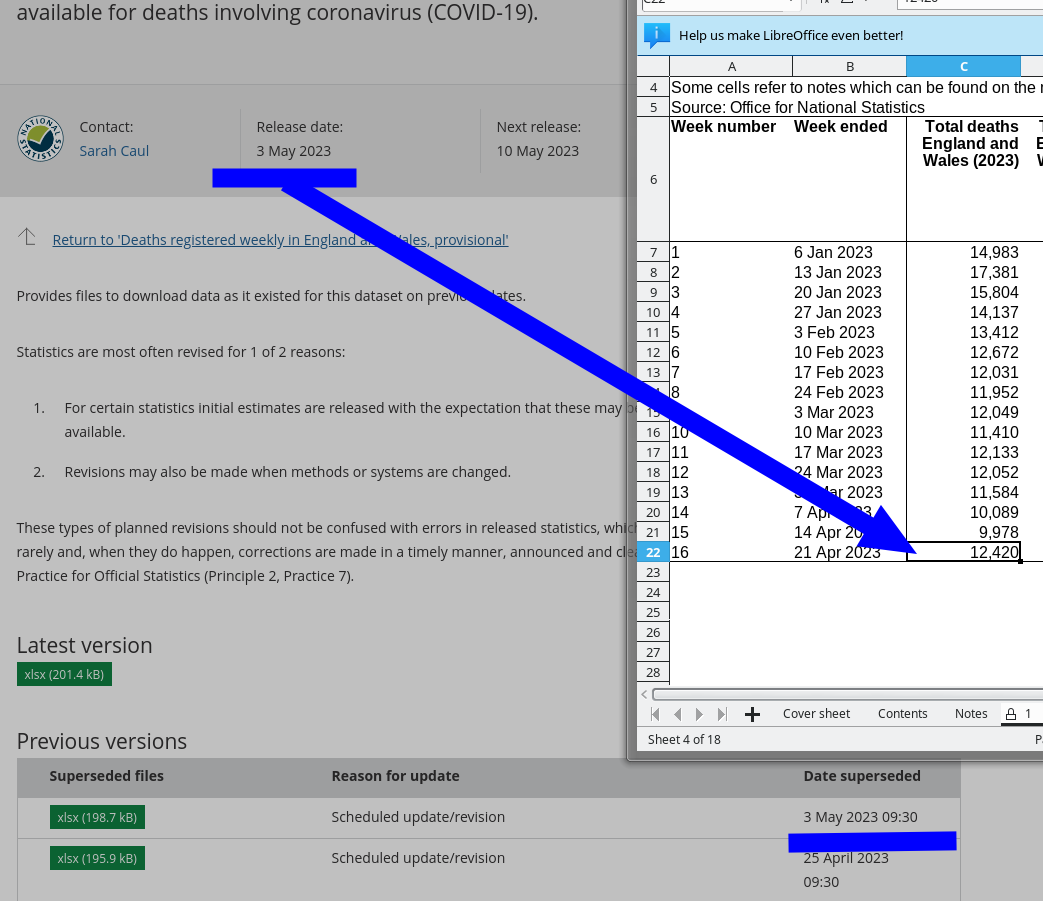

urther to what I published on Wednesday, here’s a breakdown of increase in deaths by age group, debunking the notion that it is impacting only very old people.

urther to what I published on Wednesday, here’s a breakdown of increase in deaths by age group, debunking the notion that it is impacting only very old people.

Filed under:

Filed under:

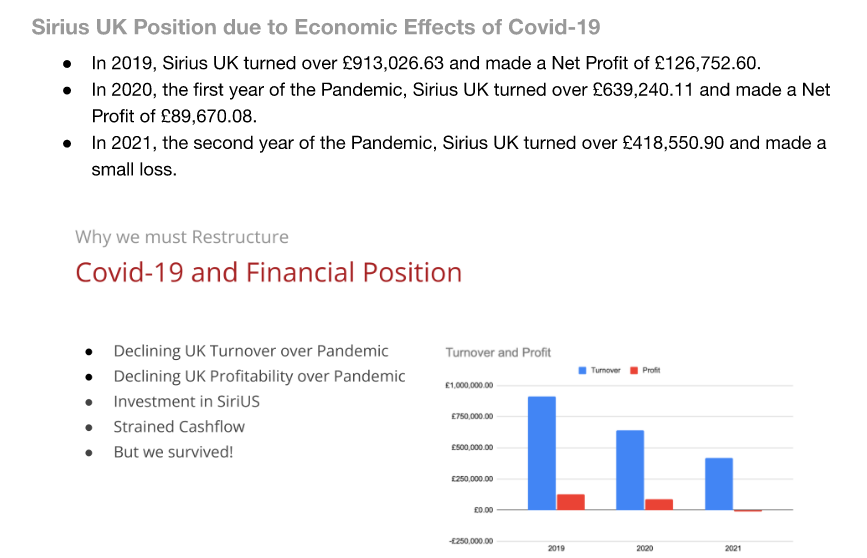

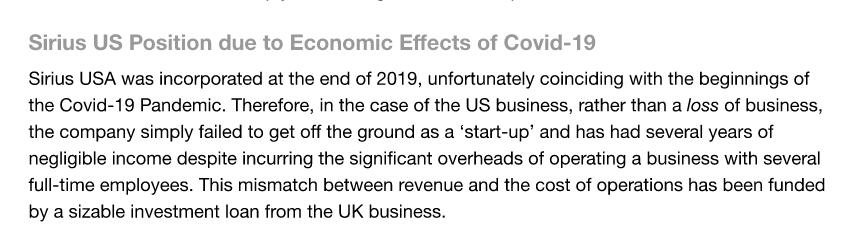

VER the past few months we showed how unreliable UK pension providers are (or have become) and how uncooperative they can be when pension fraud is indisputably confirmed. To them, the real problem is their image, their reputation. They depend on that to attract “business” and they couldn’t care any less about the integrity of the system they’re built upon. Deep inside they know about it being ripe for — or rife with — abuse. Two months ago I saw or witnessed (firsthand) the

VER the past few months we showed how unreliable UK pension providers are (or have become) and how uncooperative they can be when pension fraud is indisputably confirmed. To them, the real problem is their image, their reputation. They depend on that to attract “business” and they couldn’t care any less about the integrity of the system they’re built upon. Deep inside they know about it being ripe for — or rife with — abuse. Two months ago I saw or witnessed (firsthand) the