Can’t Have Your Pension Now (and Don’t Even Talk to Us)

Summary: Sirius ‘Open Source’ has chosen rather questionable pension providers that ‘cover up’ for the company’s abusive behaviour

TODAY we resume the series not because of progress but due to a lack of progress. We set some deadlines or ultimatums and those have already been missed/exceeded by over a week. The short stories, as we shall tell them in the coming days, might not be applicable to all pension providers in the UK, only at least two of them — the ones I’ve dealt with personally for months already (as did former colleagues).

Before we share some audio of conversations (likely some time tomorrow or later this week) let’s just say that this is still an ongoing investigation. At least 2 people were saying they cannot find anything about me on their system. Upon escalation, however, a “Standard Life” supervisor or line manager or whatever (Leah Brown) said the pension had been transferred (why could her colleagues not see the name?) but still refused to give all sorts of critical information. This was done without any authorisation from those impacted and, yet worse, without even notifying them that it happened.

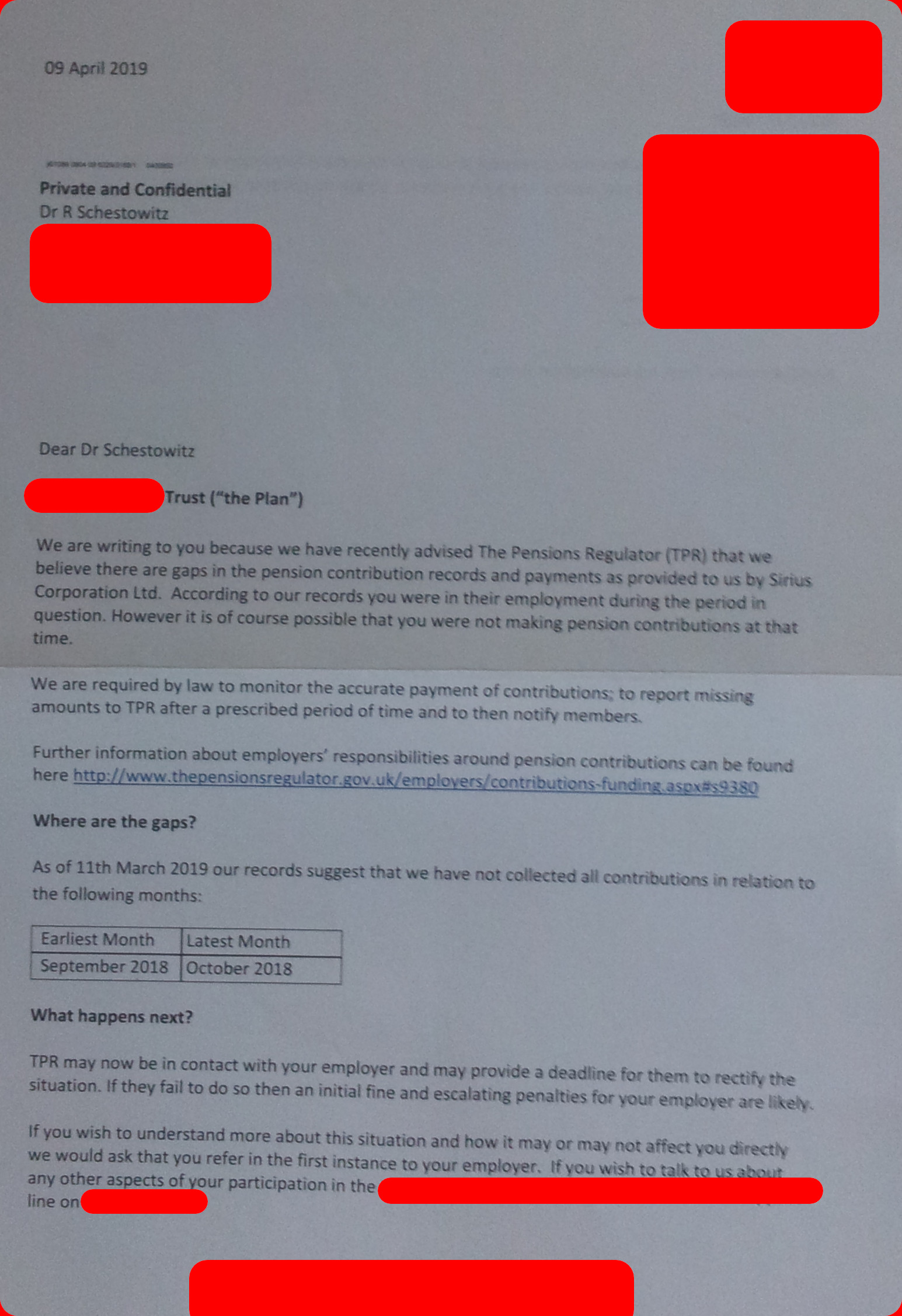

This investigation of ours follows some pension-related abuses at Sirius, as covered here back in December (we shared some letters too). It was escalated further in light of two revelations: 1) the older pension ‘vanished’. 2) the existing one is being elusive, the provider evasive, and those who phone to ask about it are being provided with only “template” responses.

At first, I had to submit complaints to them at least twice only to finally receive a phonecall (about 3 weeks late). At a later stage they sent out an E-mail:

Dear Roy,

Thank you for contacting [redacted].

Following on from our conversation on Friday the 6^th of January 2023, I can confirm your employer has now sent us over the contributions for October and November.

I’ve arranged for a contribution history to be sent to your home address within 10 working days.

If you need any more help, we have a new alternative way for you to make your request digitally. You can securely confirm your details and send your request to our team *here.*

[redacted]We would also appreciate if you could click on the link below and let us know how we did today.

Kind Regards,

[redacted]

[redacted] Helpdesk

I then responded:

Dear [redacted] (or colleague),

There seems to be about 5000 pounds missing. The statement was received by post, but it lacks about 5 years of my pension — money passed to you from another provider back in 2016. Please phone us, as before, to clarify why the statement omits this. I’m on [redacted]

My reference number is [redacted]

Regards,

They never responded to this. They never followed up at all.

After a long while (maybe days) I said:

Please phone me and my wife ASAP. We both have pensions with you and it is a matter [that's] urgent because:

a) there seems to be a lot of “missing” money

b) the employer may be committing fraud

c) I am a whistleblower (see (b)), so they might try to retaliateRegards,

PS – call me today, it is very urgent.

There were several more messages like this (about 5 in total, sent days apart).

They did not reply to this either. Days later I phoned them up and they lied to me. They gave false, empty assurances. I sent the following:

Hi,

Your handling of clients is totally irresponsible and completely unacceptable. You did not reply to any of my urgent E-mails (about 5 of them), so after a week I phoned you up, at my expense, and spoke for nearly an hour with [redacted]. He later spoke to my wife as well.

We both demanded written assurances that the former employer cannot plunder the pension like it did with our previous one. You said you would send us written assurances within 10 working days. Today we finally received two letters, but those are just balance statements (like a template reply) and nothing else. It’s a repeat of what you sent us before. It’s redundant. Nothing at all was written for us. In other words, [redacted] gave us false verbal assurances and you gave us nothing at all.

Hence, I hereby demand that you send us the money of our current balance (yes, I am aware of the very high taxes). Phone us immediately. We live nearby and will come to collect our money ASAP.

You failed us repeatedly. You failed numerous times. You gave false assurances. You moreover fail to heed our warning about an employer (your client) that plunders people’s pensions. This bodes well for the pension sector as a whole.

Please phone us now to arrange collection of our funds.

At this stage we already spoke to other victims; we suspected they had paid us salaries using our own money (our pensions) without telling us. Or maybe someone paid his mortgage using our pension money. Whatever it is, many people’s money seems to have gone “missing”.

I wrote to them again:

Hi [redacted],

My wife and I still wait for the letters you promised us. If we don’t hear back in the next day or so, we’ll take this public.

That was over a week ago. They just lied over the telephone (we have that recorded as proof) and they never responded to any E-mail. It’s as if their policy became, “do not speak to the client” (if the client phones us, lie to the client).

And we just got the phone bill 4 days ago. We paid almost 20 pounds for phonecalls (to just one pension provider, not even counting the other one).

A financial firm that kept lying or made false promises would typically not survive, would it?

Among the other expenses in the phone bill:

08 Feb

13:10

[redacted]

Calls to UK landlines

00:25:06

£5.9427 Jan

09:20

[redacted]

Calls to UK landlines

00:45:53

£10.5127 Jan

09:19

[redacted]

Calls to UK landlines

00:01:12

£0.46

This story isn’t over and it’s still an ongoing dispute. The other pension provider is even more scandalous, but we’ll cover that separately (some former colleagues are also “on the case”).

As one former colleague put it, “I was in the [redacted] one and got the weird e-mails saying some payments were missing but when I got a statement from them they had all been fixed” (or so we’re told; there are other issues).

The bottom line is, if you work for a company that has gone rogue and is acting ‘dodgy’ (British slang), then you might want to check what pension provider it chose and what happens ‘behind the scenes’. They may be arranging the looting of staff’s salaries (or partial wage theft) under the guise of “pension”.

Filed under:

Filed under:

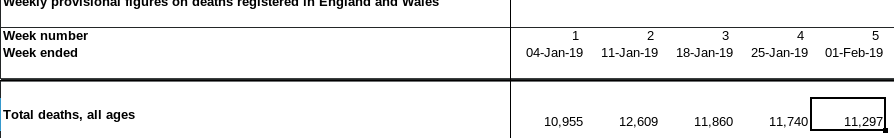

HAVE just grabbed the latest data, which was published 20 minutes ago. Be careful not to read government spin or ONS’s attempt to ‘editorialise’ this data, basically comparing peak pandemic years to the present instead of pre-pandemic times. Here are the numbers of deaths for 2019:

HAVE just grabbed the latest data, which was published 20 minutes ago. Be careful not to read government spin or ONS’s attempt to ‘editorialise’ this data, basically comparing peak pandemic years to the present instead of pre-pandemic times. Here are the numbers of deaths for 2019:

arah Caul’s (ONS)

arah Caul’s (ONS)